This function offers a fact sheet with detailed information about Portugal.

KEY FACTS

general information

OFFICIAL NAME:

Portuguese Republic

TYPE OF GOVERNMENT:

Parlamentary Democracy

HEAD OF STATE:

H.E. President Mr Aníbal Cavaco Silva

HEAD OF GOVERNMENT:

H.E. Prime Minister Mr José Socrates

CAPITAL:

LISBON

TOTAL AREA:

92.090 km² (Continent: 88.967 km²)

POPULATION:

10.617.575

RELIGION:

97% Roman Catholic

OFFICIAL LANGUAGE:

Portuguese

EU MEMBERSHIP:

since 1986

population (2007)

POPULATION:

10.617.575

ACTIVE POPULATION:

5.618.300 (52,9%)

POPULATION GROWTH RATE:

0,3% (1990/2005)

POPULATION DENSITY:

115,3 hab/km²

URBAN POPULATION:

56%

POPULATION DISTRIBUTION:

by age group

| 0 - 14 |

15,34% |

| 15 - 24 |

11,64% |

| 25 - 64 |

55,60% |

| 65+ |

17,42% |

POPULATION ORIGIN

| Portuguese | 95,8 % |

Immigrants

(Brazilians, Cape Verdeans, Ukrainians, Angolans) | 4,2 % |

POPULATION OF MAIN CITIES

(2001, not including metropolitan areas)

| Lisbon | 564.657 |

| Porto | 263.131 |

| Braga | 109.460 |

| Coimbra | 101.069 |

| Faro | 41.934 |

GEOGRAPHIC FEATURES

Portugal occupies the western part of the Iberian Peninsula. The archipelagos of Azores and Madeira in the Atlantic Ocean are included in the Portuguese territory. Portugal's northern and eastern boundaries are with Spain. On the south and west it faces the Atlantic, with a coastline of 837 km. This excellent geographic position on the extreme south-west point of Europe permits rapid access to European markets and to the US eastern seaboard and Africa. The country is crossed by three large rivers that rise in Spain, flow into the Atlantic and divide the country into three geographic areas. The Minho River, part of the northern boundary, cuts through a mountainous area that extends south to the vicinity of the Douro River. South of the Douro, the mountains slope to the plains around the Tejo River, Portugal's largest river. The remaining division is the southern one of Alentejo and Algarve.

The coast, also generally flat, contrasts with the interior highlands.

The highest peaks of continental Portugal are found in a mountainous range in the centre of the country where Serra da Estrela reaches 1.991 m.

Portugal has two climatic zones: the northern zone characterized by an average annual precipitation of 991mm with temperatures influenced by Atlantic air currents and the Spanish Meseta, and the southern zone which has a Mediterranean climate with low annual precipitation and sunny days with weather conditions influenced by the Azorean high pressure system. The average temperatures vary between 10ºC in Winter and 23ºC in Summer.

Land boundaries:

1.214 km

Coastline:

1.793 km

Terrain:

mountainous north of the Tagus River, rolling plains in south.

Elevation extremes:

lowest point: Atlantic Ocean 0m

highest point: Ponta do Pico on Ilha do Pico in Azores 2.351m

Natural resources:

fish, forest (cork), iron ore, copper, zinc, tin, tungsten, silver, gold, uranium, marble, clay, gypsum, salt, arable land, hydropower.

Land use:

| Arable land | 21,75% |

| Permanent crops | 7,81% |

| Other | 70,44% |

Irrigated land:

6.320 km²

KEY ECONOMIC INDICATORS 2007

| Private consumption |

106.043 |

65% |

| Public consumption |

33.050 |

20.3% |

| Investments |

36.069 |

22.1% |

| Exports of goods and services |

53.209 |

32.6% |

| Imports of goods and services |

-65.252 |

-40% |

| Gross Domestic Product (m.p.) |

163.119 |

100 |

|

| Real growth rate of GDP |

1.9% |

| GDP per Capita m.p. |

15.400€ |

| General government overall balance (% of GDP) |

-2.6% |

| Consolidated gross public dept (% of GDP) |

63.6% |

| Unemployment rate |

7.6% (2008) |

| Inflation rate |

2.5% (2007) |

POLITICAL FRAMEWORK

Constitutional System:

A Republic ruled by a Constitution. The Constitutional System includes the President of the Republic who represents the Portuguese Republic, the Assembleia da República (Parliament) that represents the Portuguese citizens, the Government and the Courts of Law which administer justice in the name of the people and act solely in accordance with the law and whose decisions are binding for all public and private entities. With the exception of the Law Courts, these sovereign organs (excepting the Government) are elected by direct, secret and periodic vote by the people.

Parliament:

is formed by 230 seat Congress of Deputies. General elections are held every four years. The last were held on February 20, 2005.

President:

is directly elected for a maximum of two consecutive five-year terms. If no candidate obtains more than 50% of the votes in the first round, the two candidates with the greatest number of votes go forward to a second and final round; next presidential elections will be in 2011.

Main Political Parties:

Portuguese Socialist Party (PS), Social Democratic Party (PSD), Popular Party (CDS/PP), Portuguese Communist Party (PCP), Leftist Group (BE). The Greens (PEV).

Ruling Party:

is the Portuguese socialist party (PS) which has 121 deputies in parliament. The main opposition party is the social democrat party (PSD) with 75 deputies.

Legal System:

based on the Constitution of 1976, amended most recently in 2004.

Electoral system:

universal direct suffrage from the age of 18. The d'Hondt system of proportional representation is used in 20 multimember constituencies.

Territorial Organization of the State:

The State is divided into freguesias (parishes), municipalities, distritos and Autonomous Regions. There are two Autonomous Regions, the archipelagos of Azores and Madeira. Under the Portuguese Constitution, approved by parliament in 1976, each Autonomous Region has its own basic institutional statutes which are recognized and protected by the state as an integral part of its set of laws.

Administrative divisions:

two Autonomous Regions, (Azores and Madeira), and 18 distritos on the mainland.

Distrito's capitals:

Aveiro, Açores, Beja, Braga, Bragança, Castelo Branco, Coimbra, Evora, Faro, Guarda, Leiria, Lisboa, Madeira, Portalegre, Porto, Santarem, Setubal, Viana do Castelo, Vila Real, Viseu

ECONOMY

ECONOMIC ACTIVITY

| Agriculture and fishing: |

7,9% |

| Industry (including construction): |

25,9% |

| Services |

66,2% |

| Industrial prices: |

3,2% |

| Consumer prices (inflation rate): |

2,6% |

Investment (gross fixed):

21% of GDP (2007 est.)

Industrial production growth rate:

1,8% (2007 est.)

BALANCE OF PAYMENTS

(million euros, 2008)

|

| Goods: | -21.108 |

| Services: | 6.906 |

| Incomes: | -8.295 |

| Current transfers: | 2.496 |

|

| Direct investment: | -1.656,7 |

| Portfolio investment: | 13.475,2 |

| Financial derivatives: | 709,4 |

| Other investment: | 2.412,2 |

| Reserve assets: | -78,9 |

GDP PER ACTIVITY SECTOR

|

| Agriculture and fishing |

3.798 |

2,4 |

| Industry, including Energy |

24.223 |

15,6 |

| Construction |

8.691 |

5,6 |

| Services: |

96.936 |

62,5 |

| Net taxes on products |

21.483 |

13,9 |

LABOUR MARKET

Employment contracts

Legal clauses regulate employment contracts and to a lesser degree collective agreements and individual negotiations.

Salaries

National monthly minimum wage as of 01/01/2009: 450 euros.

|

| Industry: | 8,49 € |

| Services: | 10,81 € |

| Tourism: | 6,90 € |

|

| Employer: |

23,75% |

| Employee: | 11% |

|

| Fulltime: | 40 hours |

| Retirement age: | 65 |

Unions

The main unions are the: CGTP (Confederação Nacional dos Trabalhadores Portugueses) and the UGT (União Geral de Trabalhadores)

CHARACTERISTICS OF PRODUCTIVE SECTORS

Portugal's economy is based on traditional industries such as textiles, clothing, footwear, cork and wood products, beverages (wine), porcelain and earthenware, glass and glassware, fish canning, tourism and metalworking, oil refining and chemicals.

In addition, the country has increased its role in Europe's automotive sector and has a world-class mold-making industry. Services, particularly tourism, are playing an increasingly important role. A considerable part of continental Portugal is dedicated to agriculture, although it does not represent most of the economy. The south has developed an extensive monoculture of cereals and olive trees and the Douro Valley in vineyards.

Portugal is a traditional wine grower; Port Wine and Vinho Verde (Green Wine) are the leading exporters. Portugal is also a quality producer of fruits, namely the Algarve oranges and Oeste region's Pera Rocha (a type of pear). Other exports are horticulture, floriculture, beet sugar, sunflower oil, and tobacco. Manufacturing has sharply changed its traditional profile moving from high dependence on textiles, footwear, ceramics, cork, ship repair, food and drink industries to a position where new sectors are growing dynamically, which include among others: motor vehicle and vehicle components, electronics and pharmaceuticals.

Modern industries have developed significantly, including: oil refineries, petrochemistry, cement production, automotive and ship industries, electrical and electronics industries, machinery and paper industries. The automotive industry is the main Portuguese export sector with an annual amount of 6,3 billion euros of which 3,8 billion for components only. Partnerships with foreign industrial companies together with locally developed technologies have helped the Portuguese automotive industry achieve higher performance levels, innovation and improved production capabilities. Portugal is trying to develop a cultural and rustic tourism, rather than only beach tourism, in order to attract tourists interested in getting to know the real Portugal.

TRANSPORT INFRASTRUCTURE

Roads:

As major investment was made during the past ten years Portugal has a modern road network consisting of 2.091 km auto-estradas (AE, motorways), 1.085 km itinerários principais (IP, main trunk roads), 1.294 km itinerários complementares (IC, complementary trunk roads), 4.910 km estradas nacionais (EN, national roads) and 4.500 km estradas municipais (municipal roads). It connects most of the country and provides rapid access to Spain.

Railways:

The Portuguese railway company is divided in CP - Caminhos de Ferro Portugueses (www.cp.pt), responsible for train operations and REFER (Rede Ferroviária Nacional), responsible for the network. It offers a vast rail network covering the whole of mainland Portugal and also international train services to Vigo, Madrid and Paris.

The Alfa pendular trains offer a fast and comfortable rail link between Lisbon and the Algarve and, in the north, Porto, Braga or Guimarães, with stops in Coimbra and Aveiro. The Intercity and regional train service links this cities with many other cities throughout the country. In 2004, 133 million passengers and 9.5 million tonnes of freight were carried over the 2830 kilometres of the network. The urban units are especially important since they represent 87% of all the passengers carried. The two principal metropolitan areas have subway systems: Lisbon Metro and Porto Metro. Both systems are linked by sharing stations with high-speed Pendolino trains (Alfa Pendular) that link both cities. The construction of a high-speed TGV line connecting Porto and Lisbon, and Lisbon with Madrid will begin in 2008.

Ports:

With a coastline on the Atlantic Ocean, Portugal's ports represent an important advantage for multinational companies shipping products throughout the world. The main seaports are Lisbon in the centre, Leixões (Porto) in the North and Setúbal and Sines in the South.

Airports:

The main airports are Portela (Lisbon), Francisco Sá Carneiro (Porto) and Faro (Algarve), which are served by most of the major international airlines. The national airlines are TAP Air Portugal and Portugalia.

DISTRIBUTION

Business to Consumer market:

In 2004, hypermarkets represented 37% of the total turnover of the distribution market, supermarkets represented 28%, neighbourhood supermarkets represented 18,3% and neighbourhood food stores represented 1,4%.

Three large groups share the market: Modelo Continente, Jeronimo Martins (Pingo Doce and Feira Nova) and the French Groups Auchan (Jumbo) and Continente. The other major visible trend in the last few years has been the development of large retailers such as the Belgian group Bricodis, the Scandinavian group Habitat, and the French group FNAC.

Thus in the coming years, this changes will inevitably result in a continuing decline in the market-share of traditional retailers, and an increase in hypermarkets and supermarkets which will be increasingly expanding their range of products and services in the non-food sector.

Business to Business market:

Sectors such as construction, the environment, medical equipment, information technology, communications, fishing, and transportation are the growth oriented sectors at the moment.

One of the solutions often advised as the first approach toward entering this market is to appoint a local agent who can also respond to public tenders.

The franchise market is constantly developing in the country. There were 370 franchise networks and more than 7.800 franchise outlets in the country at the end of 2003. 49,5% of all franchises were clothing stores (Zara, El Corte Ingles, Cortefiel, etc) and 40% were service establishments. 41% of all franchises are of Portuguese origin, 24% Spanish, 11% American, 8,3% French, and 4,3% are of Italian origin.

BANKING SERVICES

The Bank of Portugal is the country's central bank. All public banks have been privatized, except the Caixa Geral de Depósitos Group.

Amongst the main Portuguese banks with subsidiaries, branches or representative offices abroad are: Banco Português de Investimento (BPI), Millenium bcp, Banco Espírito Santo (BES), Banco Santander Totta, Montepio and Caixa Geral de Depósitos.

Banking productivity in terms of the number of banks per 1000 inhabitants and the number of employees per branch is among the highest in Europe.

INTERNATIONAL TRADE

EXTERNAL TRADE STATISTICS (Goods) 2007

(million euros)

| Imports (cif): | 57.014 |

| Exports (fob): | 37.544 |

| Trade balance (fob-cif): | -19.470 |

Terms of Trade (2006):

(Price Index for Exports / Price Index for Imports x 100) | - 0,9% |

Coverage rate (fob/cif):

((export/import) x 100) | 65.9% |

| Degree of openness: | 58.2% |

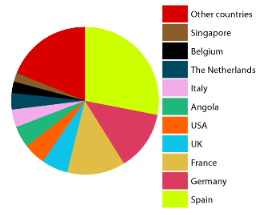

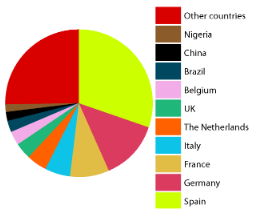

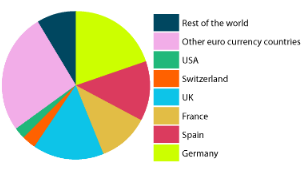

DISTRIBUTION OF FOREIGN TRADE BY GEOGRAPHIC AREA (2007)

Exports by destiny

Imports by origin

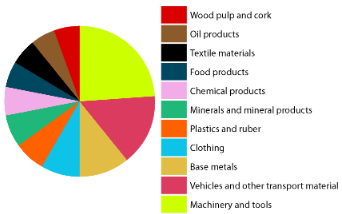

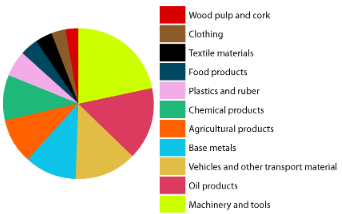

MAIN PRODUCTS (2007)

Exports

Imports

MEMBERSHIP IN TRADE AND ECONOMIC ORGANISATIONS

- European Union (EU)

- Economic and Monetary Union (EMU)

- Organisation for Economic Cooperation and Development (OECD)

- World Bank (WB)

- International Monetary Fund (IMF)

- World Trade Organisation (WTO)

- United Nations Conference on Trade and Development (UNCTAD)

- European Bank for Reconstruction and Development (EBRD)

- African Development Bank (AfDB)

- Asian Development Bank (ADB)

- Inter-American Development Bank (IDB)

International organisation participation:

AfDB, AsDB, Australia Group, BIS, CE, CERN, EAPC, EBRD, EIB, EMU, ESA, EU, FAO, IADB, IAEA, IBRD, ICAO, ICC, ICCt, ICFTU, ICRM, IDA, IEA, IFAD, IFC, IFRCS, IHO, ILO, IMF, IMO, Interpol, IOC, IOM, ISO, ITU, LAIA (observer), MIGA, NAM (guest), NATO, NEA, NSG, OAS (observer), OECD, ONUB, OPCW, OSCE, PCA, UN, UNCTAD, UNESCO, UNIDO, UNMIK, UNMISET, UPU, WCL, WCO, WEU, WFTU, WHO, WIPO, WMO, WToO, WTO, ZC

MARKET ACCESSS

Regulations

Portugal applies the European Union (EU) rules that are in force in all EU countries. While the EU has a rather liberal foreign trade policy, there is a certain number of restrictions, especially on farm products, following the implementation of the CAP (Common Agricultural Policy): the application of compensations on import and export of farm products, implies a certain number of control and regulation systems for the goods entering the EU territory.

Genetically Modified Organisms should be systematically specified on packaging. Beef cattle bred on hormones is also forbidden to import. The principle of precaution is widespread: in case of doubt, the import is prohibited until proof is made of the non-harmfulness of products.

Customs duties

Trade within the EU is totally free from customs duties, provided that the country of origin of the goods is one of the EU Member States. Nevertheless, when introducing goods into Portugal, exporters shall fill in an intrastat declaration.

When the country of origin of the merchandises is not part of the EU, customs duties are calculated Ad valorem on the CIF value of the goods, in accordance with the Common Customs Tariff (CCT).

The duties for non-European countries are relatively low, especially for manufactured goods (4,2% on average for the general rate), however textile, clothing items (high duties and quota system) and food-processing industry sectors (average duties of a 17,3% and numerous tariff quotas, PAC) still know protective measures.

In order to get exhaustive regulations and custom tariffs regarding their products, exporters shall refer to the TARIC code and its database.

Moreover, many bilateral and multilateral agreements have been signed by the European Union.

Import taxes

Excise duties are also levied on certain products, especially on spirit.

Tariffs

Arrivals of goods from other EU member countries are exempt from customs duties. Imports of goods from third countries are subject to the Common Customs Tariff duties of the EU. The national site for customs related information is http://www.dgaiec.min-financas.pt/ sitedgaiecinternet/index.html and the tariff site is http://pauta.dgaiec.min-financas.pt.

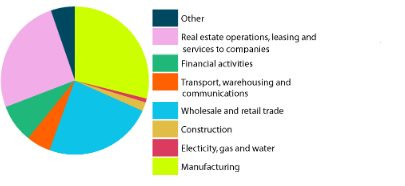

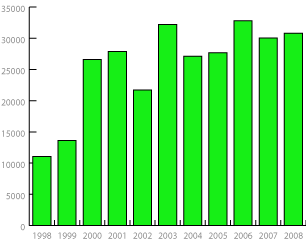

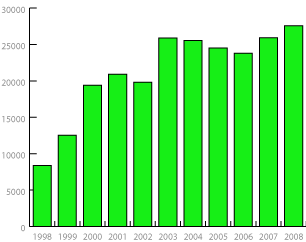

FOREIGN DIRECT INVESTMENT FDI

by country (2007)

by sector of activity (2007)

FDI inflows, in billion Euro

FDI outflows, in billion Euro

LEGAL INFORMATION

TAX SYSTEM

Three types of Value Added Tax (VAT) are imposed. The standard rate of 20% and the reduced rates of 5% and 12%: 12% for catering, petrol and some foodstuffs; the rate from 5% applies to most food products, water, publications, electricity, transport, hotel business and leisure activities.

Portugal's tax rates for individuals (IRS) are progressive. Currently the tax rate is up to 42%. Exemptions are granted to taxpayers with specific types of income.

The standard corporate tax (IRC) is 25% with the addition of a variable municipal tax making a total of up to 26,5%.

Companies with a turnover that is less than the limit defined in law may elect an alternative method of tax calculation that is based on the profit coefficients defined in the law. Companies in the free trade zone of Madeira are eligible for a reduced tax rate up to 3%.

The

Fact_sheet.TaxesInPortugal shows the most important types of taxes a business has or may have to comply in Portugal. NOTE that there are special rates for most taxes in the Autonomous Regions of Azores and Madeira which are lower than those for the rest of country.

Companies can also establish in the Madeira Free Zone, a restrictive area in the Autonomous Region of Madeira, and benefit from a very favourable tax regime.

Click here to open the Fact_sheet.TaxesInPortugal »

STANDARDISATION AND CERTIFICATION

The Portuguese Quality Institute (IPQ) is the body responsible for almost all normalisation procedures. However, some products are still bound to other organisations, such as the Institute of Electromechanical Engineering and Energy (IEE) and the Institute for the Protection of the Food-processing Products.

EU standards are compulsory. The ISO 9000 standard is optional, but remains a proof of competitiveness.

PROTECTION OF PATENTS AND TRADEMARKS

The body responsible for the protection of intellectual property is the Instituto National da Propriedade Industrial (INPI). Portugal is a member of the Paris Convention for the Protection of Industrial Property and of the World Intellectual Property Convention. Portugal ratified the agreement of Munich for European patents, as well as the treaty of cooperation in patents (PCT).

With regards to trademarks, Portugal signed the Madrid Agreement and the Madrid Protocol under which the Madrid System for the International Registration of Marks functions.

The European Patent application can be submitted to the Portuguese Patent and Trademark Office (www.inpi.pt), and afterwards processed and granted in the European Patent Office,

whose headquarter is in Munich. The Community Trade Marks (CTM) applications can be filed either directly at the OHIM (Office for Harmonisation in the Internal Market-headquarter in Alicante, Spain) or at any of the central industrial property offices of the Member States of the Community or the Benelux Trade Mark Office.

ROAD TRANSPORT

The following international Road Transportation Conventions are valid

CMR

Convention on the Contract for the International Carriage of Goods by Road (CMR), of 19 May 1956 (UNECE Transport Agreements and Conventions No. 25),

ADR

European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR),

ATP

Agreement on the International Carriage of Perishable Foodstuffs and on the Special Equipment to be used for such Carriage,

TIR

Customs Convention on the International Transport of Goods under Cover of TIR Carnets and the Council Regulation (EEC) No 881/92 of 26 March 1992 on access to the market in the carriage of goods by road within the Community to or from the territory of a Member State or passing across the territory of one or more Member States.

PRACTICAL INFORMATION

CURRENCY

|

| Period |

2005 |

2006 |

2007 |

2008 |

| US DOLLAR/EURO |

1,2441 |

1,2556 |

1,3705 |

1,4708 |

STANDARD TIME

Portugal Time (Mainland and Madeira) is Greenwich Mean Time (GMT), the Azores are one hour behind continental Portugal. Like most states in Europe, Summer Time is observed in Portugal Time, where the time is shifted forward by 1 hour (GMT+1).

WORKING HOURS

BANKS:

Are open from 8.30 to 15.00, Mon-Fri, closing on public holidays.

CITIZENS OFFICE:

(loja do cidadão) Mon-Fri: 8.30 to 19.30, Sat: 9.30 to 15.00

SHOPS:

Opening time is 9.00 to 19.00, Mon-Fri. Most of the shops are open on Saturday mornings, even though there are some open in the afternoon.

SHOPPING CENTRES:

Are open from 10.00 to 23.00 or midnight, every day of the week.

POST OFFICES:

Are open during the week from 9.00 to 18.00 and closed on weekends. In main cities there is one post office station open on Saturdays.

MUSEUMS:

From 10.00 to 12.30 and from 14.00 to 17.00. Closed on Mondays.

HOLIDAYS

There are 13 mandatory official holidays

| New Year's Day |

| may occur on another day that has local significance during the Easter period |

|

| Carnation Revolution |

| Labour Day |

| Movable feast |

| National Day |

| Assumption of Mary |

| Proclamation of the Republic |

| All Saints' Day |

| Restoration of Independence |

| Immaculate Conception |

| Christmas Day |

Besides mandatory official holidays the only optional official holidays that may be observed are Carnival Tuesday and the local municipal holiday.

An annual vacation of a minimum length of 22 working days is compulsory.

ELECTRICAL CURRENT

The voltage is 220 volts AC, with a continental round pin plug.

ENTRANCE REQUIREMENTS

Portugal is a signatory of the 1995 Schengen Agreement. Passport valid up to 6 months (depending on nationality) required by all except: EU nationals and nationals of Iceland, Liechtenstein, Malta, Norway and Switzerland holding valid national ID cards.

Nationals of the EU and certain other European Countries can live and work in Portugal without a visa or work permit. Non-EU nationals require a visa to enter Portugal if they plan to stay longer than 90 days or intend to work or study here.

Visas should be applied for well in advance, from a Portuguese consulate or embassy.

CONNECTIONS

By air:

There are international airports at Lisbon, Porto and Faro. The national airlines are TAP Air Portugal and Portugalia.

By coach:

There are three companies running services between many European cities and Oporto (Inter-Norte), Lisbon (Inter-Centro) and Faro (Inter-Sul).

By train:

Daily international trains run between Paris-Lisbon (Sud Express), crossing the border at Vilar Formoso; between Lisbon-Madrid, crossing the border at Marvão; and between Oporto-Vigo, crossing the border at Valença. Portuguese Railroads. www.cp.pt

By sea:

Coastal shipping is increasingly important, both for leisure cruises and cargo shipments due to deep sea ports. The main ports are in Aveiro, Funchal, Leixões, Lisbon, Setubal, Sines and Viana de Castelo.

USEFUL ADDRESSES

Bank of Portugal

R.Francisco Ribeiro, 2

1150-165 Lisbon, Portugal

Tel: +351 21 313 00 00

Fax: +351 21 314 39 38

www.bportugal.pt

AICEP Portugal Global

(Agência para o Investimento e Comércio Externo de Portugal, E.P.E.) Business Development Agency

O'Porto Bessa Leite Complex

R. Antonio Bessa Leite, 1430 - 2º

4150-074 - PORTO

Tel: +351 22 6055300

Email:

aicep@portugalglobal.pt

www.portugalglobal.pt

Sources

Portuguese Business Association (AEP), Business Development Agency (AICEP), Bank of Portugal, Portuguese Directorate General for Land and Water Transport (DGTT), Portuguese Directorate-General for Traffic (DGV), European Seaports Organisation (ESPO), Eurostat, International Monetary Fund (IMF), National Statistics Institue (INE), Portuguese Patent and Trademark Office (INPI), Portuguese Quality Institute (IPQ), Ministry of Economy and Innovation, Ministry of Finance, Ministry of Foreign Affairs, Ministry of Labour and Social Solidarity, OECD, Portugal Airports, Portuguese National Railways, UNICEF, World Bank